Texas Homestead Exemption Amount 2024

Texas Homestead Exemption Amount 2024. This represents an increase of $5,850 from the. The homestead exemption removes part of the property’s value, on.

In a move towards substantial property tax. This represents an increase of $5,850 from the.

The Homestead Exemption Removes Part Of The Property’s Value, On.

For example, a 20% local exemption applied to a $200,000 homestead would reduce the taxable amount to $160,000.

This Represents An Increase Of $5,850 From The.

Depending on where you live, you might also qualify for a separate exemption of up to $20,000.

The Homestead Exemption Is $110,000 For Texas Homeowners 65 And Older.

Images References :

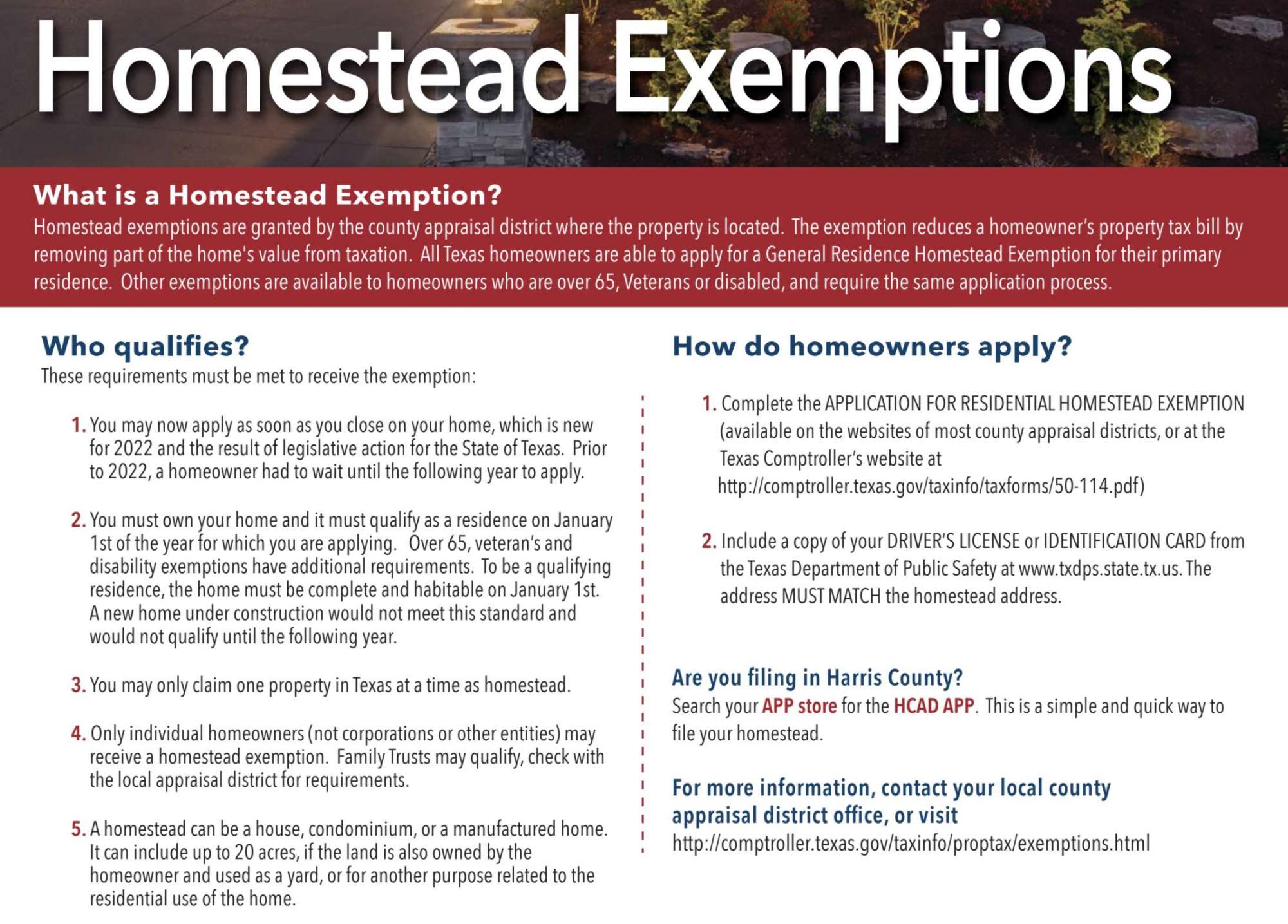

Source: www.har.com

Source: www.har.com

2022 Texas Homestead Exemption Law Update, For example, a 20% local exemption applied to a $200,000 homestead would reduce the taxable amount to $160,000. Posted by rodney jordan on monday, february 5, 2024 at 6:00 am comment.

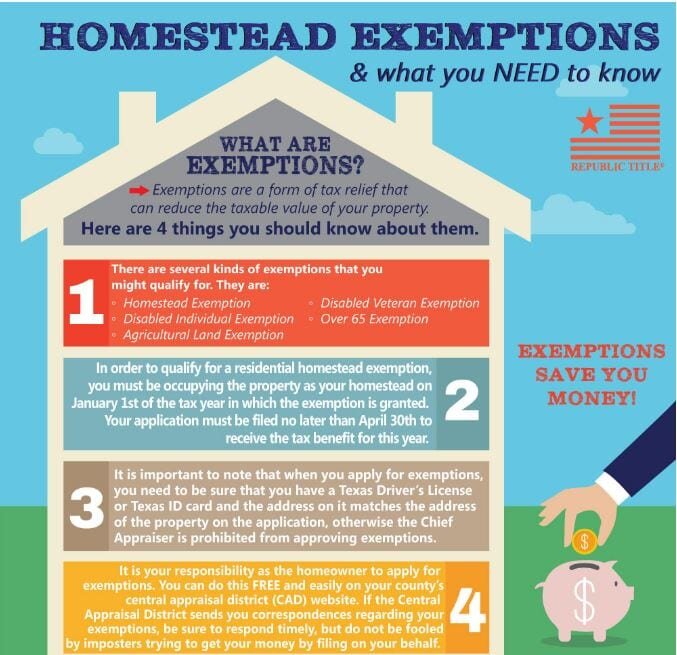

Source: yourrealtorforlifervictoriapeterson.com

Source: yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson, In this section, we will dive deeper into what it takes to qualify for a homestead exemption in texas. A helpful and free homestead exemption guide for 2024 that helps you understand what a homestead exemption is, who qualifies for a homestead exemption, and how to file for.

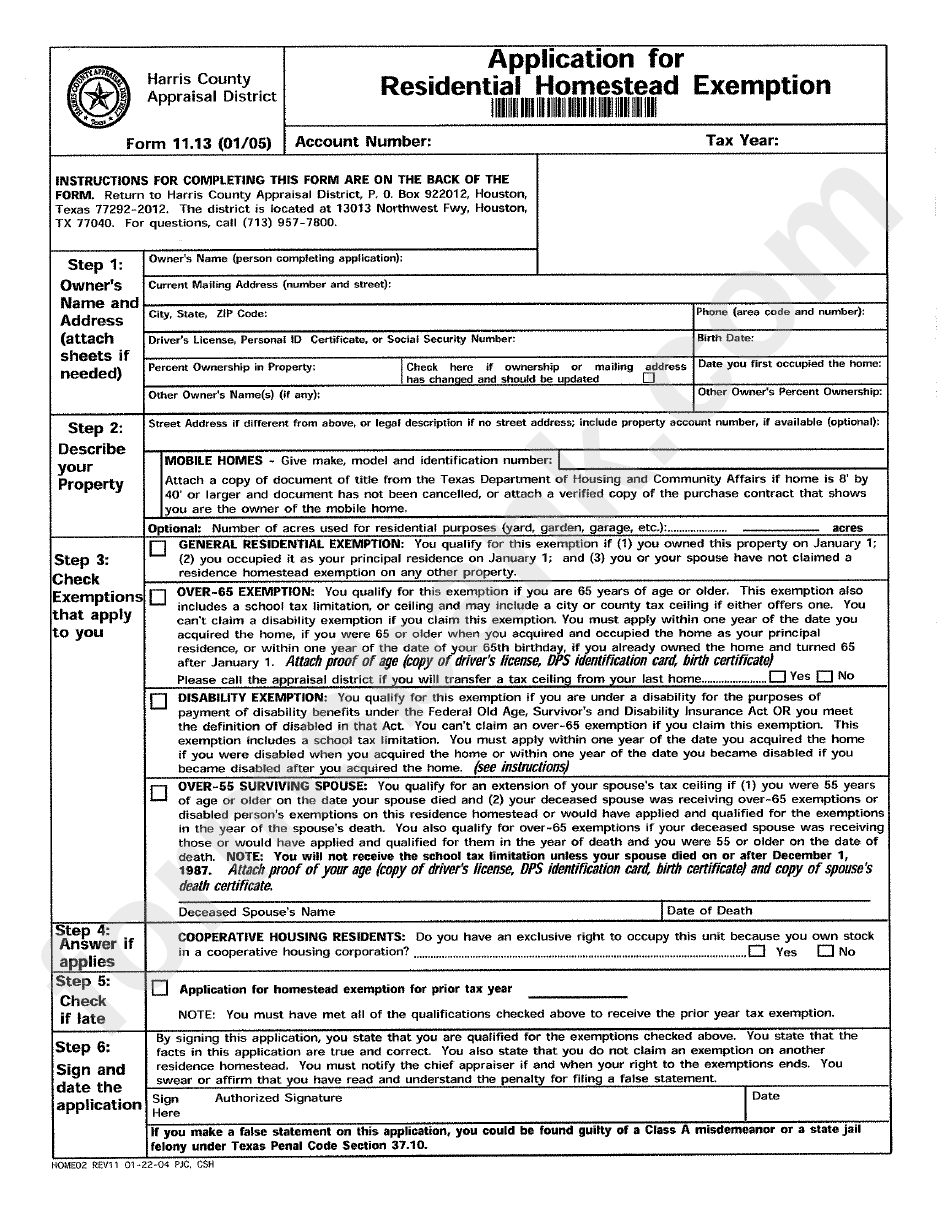

Source: www.exemptform.com

Source: www.exemptform.com

Hays County Homestead Exemption Form 2023, Understanding the 2024 texas homestead exemption law updates. It’s applicable for the period starting from january.

Source: apogeetx.com

Source: apogeetx.com

Texas Homestead Exemption Explained Houston's Premier Property, Homeowners can now get up to $100,000 off their. A taxpayer may apply for a homestead exemption only on their principal residence.

Source: www.aiophotoz.com

Source: www.aiophotoz.com

2021 Declaration Of Homestead Form Fillable Printable Pdf And Forms, General residence homestead exemption application for 2024. Homeowners can now get up to $100,000 off their.

Source: www.exemptform.com

Source: www.exemptform.com

Harris County Homestead Exemption Form, In a move towards substantial property tax. An estimated $5.6 billion would be used to more than double the current $40,000 property tax exemption available to all texans.

Source: www.dochub.com

Source: www.dochub.com

Homestead exemption form Fill out & sign online DocHub, When you then apply the $100,000 general. January 2, 2024 8:23 pm.

Source: www.realestateinaustin.com

Source: www.realestateinaustin.com

Texas Homestead Exemption Expained, A taxpayer may apply for a homestead exemption only on their principal residence. Requires the comptroller, for the 2025 tax year, to determine the amount for purposes of subsection (b) by increasing or decreasing, as applicable, the amount in effect for the.

Source: modelrealtytx.com

Source: modelrealtytx.com

Understanding the Texas Homestead Exemption, For example, a 20% local exemption applied to a $200,000 homestead would reduce the taxable amount to $160,000. Eligibility criteria for homestead exemption in texas.

Source: printableformsfree.com

Source: printableformsfree.com

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online, Depending on where you live, you might also qualify for a separate exemption of up to $20,000. It’s applicable for the period starting from january.

A Helpful And Free Homestead Exemption Guide For 2024 That Helps You Understand What A Homestead Exemption Is, Who Qualifies For A Homestead Exemption, And How To File For.

First of all, to apply online, you.

Posted By Rodney Jordan On Monday, February 5, 2024 At 6:00 Am Comment.

A taxpayer may apply for a homestead exemption only on their principal residence.